According to the Urban Institute, single-family rental homes are growing faster than any other demographic of the housing market. Their research shows that the single-family rental market outpaces both single-family home purchases as well as apartment purchases.

“Young people are waiting longer to get married and have children, which can make renting more economical”, says Sarah Strochak of the Urban Institute as she expanded on how single-family rentals have risen 30% in the last 3 years.

As younger generations become more active in the housing market we should expect to see these figures climb.

The rise in renting

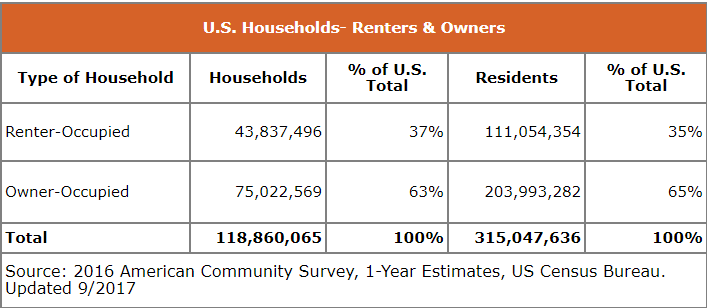

The 2008 financial crisis had a devastating effect on U.S. markets, especially the single-family housing market. While we’ve climbed back to traditional levels for things such as foreclosures and underwater mortgages, one thing that hasn’t recovered is the American population’s willingness to buy a home. The American dream of owning a home slowly began to wither and has gone from an investment everyone hoped to make to one that younger generations, such as millennial, all of a sudden have to question. Today, SFR’s and townhome rental properties make up 35% of the country’s rental properties compared to just 31% in 2006.

Without a doubt, millennials are the demographic leading this trend of renting over buying and a myriad of factors contribute to that fact. That myriad of factors includes everything from stagnant incomes, student loan debt, lack of commitment to an area and much more. For a generation that was coming of age during and just after the 2008 crisis, the hesitation to commit to a 30-year mortgage note isn’t unfounded.

However, it’s not only millennials who are affected by this ongoing shift in the housing market. Americans over the age of 55 have grown more accustomed to renting. According to RENTcafe, renters aged over 55 has grew by a total of 28% between 2009 and 2015. In areas such as Miami, Houston, and Minneapolis, more than two-thirds of new single-family renters were 65 or older.

Why did renting become so popular?

This trend in the rental housing industry was born when the recession took place. During the crash, the prices of nearly ever asset fell, including real estate. This opened the door for powerful firms and individuals to gobble up properties at huge discounts. Institutional investors were able to purchase the majority of the homes that fell under foreclosure and hard times. For example, from 2007-2010 in Phoenix, Arizona, the number of homes occupied by owners – not renters – fell by 30,000.

Renting instead of Buying

Renting can be a sensible choice over buying when looking to segment away from the apartment lifestyle, maybe even considered a stepping stone to actually purchasing. The attraction is obvious – buyers don’t need a hefty down payment to enable the sale. Traditionally, 20% is needed on a purchase but some metropolitan markets are becoming so expensive that just a 5% down payment can seem daunting to individuals.

What to know before renting a single-family residence

If you’re an individual thinking of making the switch from an apartment to a SFR, there are a few things to keep in mind. In a single-family home, utilities will be considerably more expensive. Maintenance also becomes a bigger issue when you find yourself in a home. Usually, it will be written into your lease agreement if you have any maintenance obligations to stay on top of. Renter’s insurance is important once you’re in a SFR, as your landlord’s policy more than likely won’t cover damage to or theft of your property.

If you’re an individual looking for some of the best properties to rent in Austin, Texas, be sure to check out Stone Oak Management’s available Austin rental properties.