Holiday Hours

We will be closed on Monday, April 8th for the Solar Eclipse. Our holiday schedule can be found here.

Upcoming Solar Eclipse

This is our last post before this historic event takes place. If you’re in the Central Texas area, or anywhere within the path of this eclipse, it’s not an event to miss.

We are giving our staff the day off work to enjoy the event and avoid the expected traffic from the anticipated travelers coming to town. Travis County has issued a disaster declaration to have resources available to deal with the anticipated crowds, and other counties in the path are taking action in various ways as well..

We hope that you are able to enjoy this historic event! It will be 20 years before the United States experiences this again.

Security Deposit Alternatives

With the market shifting into a more competitive phase, the incentives discussed in our previous post are one approach, and we’re working on offering another option for properties that have been on the market for a prolonged time. These alternatives are a new, yet quickly growing industry as they get tenants in the door with lower cash requirements to get moved in. You can read about Obligo here, which is the one we’re considering offering as we go through the process of vetting the various vendors.

The tenant goes through a financial screening, and if approved, pays a fee to one of these companies In turn the company guarantees payment for unpaid charges, up to the amount usually collected and held as a security deposit, at the time the tenant moves out. The fee the company charges is typically a percentage of what the security deposit amount would have been, is not refundable, it is not an insurance policy, and is guaranteed throughout the lease. If the tenant renews or becomes month to month they can pay in full or choose to prorate the initial fee over 12 months and the tenant is charged monthly to continue the coverage.

These alternatives will not be offered on all properties for several reasons as discussed below. We are piloting this offering with only a few properties that have been on the market for an extended period, and are competing directly with other properties that are offering the alternative option. The security deposit alternative is not required so the tenant will still have the option to go the traditional route. Here’s a bit more about the program and our thoughts on it-

Third-Party - introducing an outside entity into the relationship can become problematic when they are not working on your behalf. These companies all claim that they pay any charges the tenant owes at move out up to the value of the security deposit being replaced that’s established during the leasing process. Unfortunately, we do hear that some of these companies will deny payouts and there is little recourse without spending a lot of time and money to pursue it.

What Do You Get Out of This? - the only benefit to the landlord/manager is the theoretical boost in a property’s marketable value with a lower cost to move in. The company retains the full fee with no revenue sharing with the landlord/manager.

Non-Payment Upon Renewal - We have inherited a few of these deposit alternative contracts with properties we were hired to manage with existing tenants. Both companies we’ve discussed this with state that once the initial payment is made by the applicant the security deposit alternative stays intact for the duration of that lease term even if the tenant stops paying if they are set up on monthly billing instead of paying the full cost up front. At the time of renewal the policy must not be in arrears for a renewal to be offered, or they must catch up any past due balance before the alternative can be extended. We’re still vetting them, but in the end it’s a risk that they claim we don’t have to worry about when it comes to non-payment during the course of the policy term for monthly payers.

Start-Up Companies - these companies are relatively new to the market, mostly backed by large investors, and are likely operating a substantial loss as they try to create and capture the security deposit alternative market. If they fold there’s a risk that there will not be any money there to claim when the time comes. Obligo has stated they are backed by letters of credit through Wells Fargo that will pay out if the company goes under.

Not Insurance - these contracts for a deposit alternative do not work like insurance. If the tenant has charges levied against them that the company pays on their behalf then they are pursued for reimbursement. The tenant incurs the initial cost of the alternative and is then also on the hook for any charges that the company pays on their behalf. The company offers lump sum or repayment plans for any balance the tenant has, and works with them directly to collect.

Disputed Charges - The tenant retains the right to dispute any charges levied upon them, so if payment is received from the company it must be held for a period of time since any successful dispute would require returning the relative portion of the payment back to the company. This isn’t really different from the traditional deposit other than successfully disputed funds being returned to a third party instead of directly to the tenant.

Ultimately, the deposit alternative is a complicated offering that can certainly be useful if it works smoothly and helps to get a renter in place. As the industry grows and matures it will become clearer as to whether they are actually beneficial from a property owner’s standpoint. If this is something that we’re considering for your property because it has been on the market for an extended period, or other properties that are in direct competition with yours are offering them then your property manager will be in touch to discuss this option.

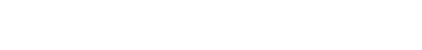

1099 Season is Upon Us

The tax forms were sent out and published electronically at the end of January. If you didn’t receive one it is because of the details provided on your W9 form. We are not required to file a 1099 in certain situations, which you can review here if you’d like more information on the IRS requirements and exceptions. If you opted for an electronic form it can be found in the documents section of your client account at stoneoakmgmt.com using the landlord login link on the top right.

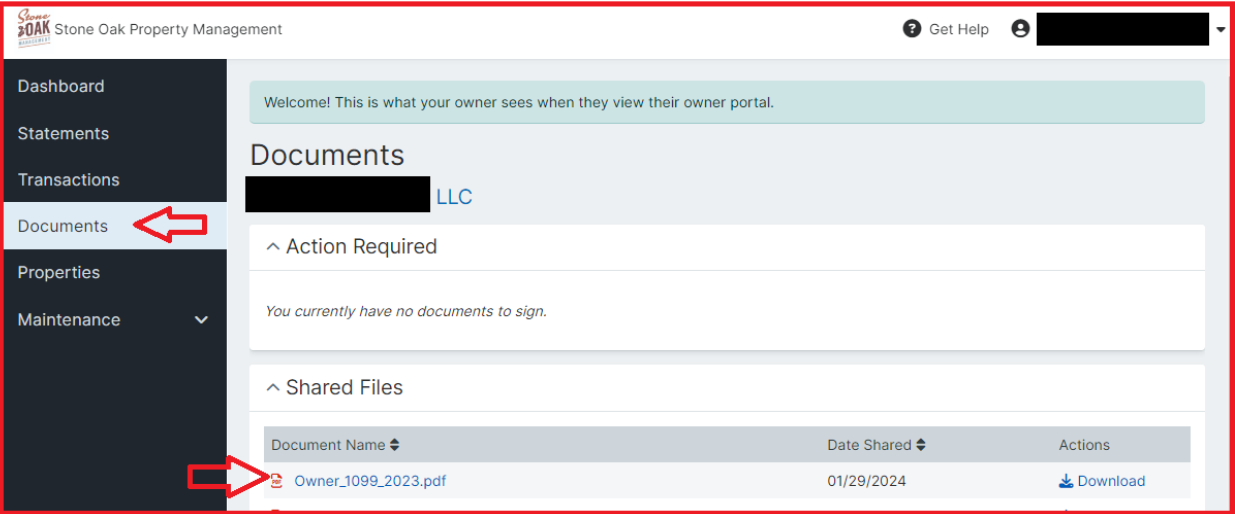

The year end statements were published to your portal and can be located in the statements section. You will see the dates covered by the statement on the left.

Tax Protests Are Around The Corner

It’s almost time for the protest season to begin, and the cycle of sending out notices of appraised value will begin in the coming months. We’ve had great success partnering with Home Tax Shield, and they’ve achieved savings for many of our clients. If you already participate in the protest process through us and Home Tax Shield you’ll get notifications directly from them as the process hits certain milestones. If you’d like to get set up to protest this year you can use the link above to get started.

Scams Everywhere!

We just want to remind you that we will never call you to ask for your bank info, social security number, or other personal information on the phone or by email. We will also never ask you to pay for anything with gift cards, cryptocurrency, etc. All of our emails will come from our domain, www.stoneoakmgmt.com, or through our software as a long string of letters/numbers from the domain @stoneoak.mailer.appfolio.us. Our property management software includes a texting service that will not match our office number, but if you try to call that number it will go directly to our main office phone line.

Here is some helpful information about Caller ID Spoofing, and other common scams. Here is a recent posting from Chase Bank about other common scams that are good to be aware of.

Please stay vigilant, maintain a healthy amount of skepticism, and contact us directly with the number on our website or our direct emails if anything looks questionable.

HOA Compliance Notices

Did you know your HOA can send important notices and compliance letters directly to Stone Oak to enforce? Yes! We can take care of that for you! Please be sure to provide your HOA with Stone Oaks direct contact information so we can ensure timely delivery of notices.

Please contact your PM for more information.

Thank you for being a client of Stone Oak Property Management. Please don't hesitate to contact your property manager should you need anything at this time.

Reminders:

Holiday Hours

We have updated our company holiday calendar in an effort to give everyone here at Stone Oak more time off with their families and friends. You can find our updated holiday closing schedule at this link.

Maintenance Approval Process Changes

In addition to the info below about funding repairs we want to notify all owners that we are modifying our escalation process when we can’t reach our clients in order to make sure we are complying with property code requirements. In bonafide emergencies we are acting within our authority to mitigate damages, however after it has been contained or in non-emergency situations we reach out to our clients for work authorization that is required above the limit set in the management agreement. In those cases we now have a strict process going into effect that will have a time-based escalation if we cannot reach you. The time frame will be that if we can’t reach you by the 3rd day from when we first reached out we will then reach out to your emergency contact who can aid us in getting authorization or contacting you. If you’d like to update your emergency contact we have on file please contact your property manager. Keep in mind that this contact should be someone outside of your immediate household who you trust to make decisions on your behalf if you cannot be reached by them or us.

Funding Make-Readies & Maintenance for Your Property

Please note that it is Stone Oak's policy that the owner has reserve funding on hand with Stone Oak to help us commence work faster when it comes to make-readies and maintenance on your property. Stone Oak cannot perform maintenance without first receiving authorization and funding, which can slow down the turn-around times of our vendors and their availability in this market. This can also potentially create a negative experience that tenants will remember when it comes time to renew, and we always want to avoid turning over the tenants. Any time we request authorization for work on your property, the best practice is to immediately fund your account when you provide written authorization to move forward. This is as simple as going into your owner portal and using ACH for a free transfer, or if you prefer a credit card the processor charges a fee as part of the transaction.

Keep in mind that tenant charges on your account are not considered an offset to this amount as we keep a strict accounting system for both our and our client's benefits. Any tenant chargeable items will be posted to their account, and once they are paid it is immediately credited to your account. If you have any questions about this reserve amount held with Stone Oak please contact your property manager.